2023 was a groundbreaking year for subscriptions Super Bundling. At the start, the subscription economy was dominated by headlines that focused on the streaming wars and what lay ahead for the likes of Netflix, Amazon and Disney.

Fast forward 12 months and the concept of Super Bundling — and its importance to the future of the subscription economy — is on the agenda of just about every telco and content aggregator. It’s also firmly on the radar of content and subscription providers.

And it’s easy to see why. Over the next 12 months, even more consumers will activate and manage their subscriptions using Super Bundling attracted by the freedom to be able to pause subscriptions alongside the provision of greater control in areas such as consolidated billing and flexible household plans.

At the same time, Super Bundling opens up opportunities for the industry to be even more creative as it looks to increase subscriber numbers and increase revenue. This includes the creation of time-specific packages, the rise of collaboration among competing brands, and new types of subscription products coming on stream as distribution channels open up.

This stratospheric rise is backed by recent research published by StreamTV — The future is bundling – which found that eight in ten (81%) of industry leaders believe Super Bundling is the future for the subscription services economy. And more than half work for organizations already engaged in rolling out a Super Bundling strategy.

It’s an amazing acceleration of events that underlines just how quickly things can change when the need is there.

Super Bundling – how did we get here?

The rise of Super Bundling can be traced back to a key piece of Bango research published in November 2022 — Subscription Wars: the subscriber strikes back — which canvassed the opinions of 2,500 subscribers in the US about the services they received. Looking back, this research has proved to be a catalyst for change. For amid all the facts, figures and findings there emerged one simple truth.

Seven in ten (72%) consumers said there were too many subscription services available. However, far from calling for choice to be limited, they simply wanted an easier way to manage and pay for all their subscriptions. More than three-quarters (78%) said they wanted a single hub. And with that unified subscriptions hub, they would buy more subscriptions.

The findings of this seminal piece of research were echoed when a second, larger survey was carried out which surveyed more than 6,000 consumers in Asia-Pacific (APAC).

Again, the message was unequivocal. When asked about their subscriptions the message was the same. They don’t want less choice. They want less admin. They want something more straightforward, more flexible and easier to use.

More than nine in ten — 93% — of consumers said they wanted a single platform to manage and pay for all their subscriptions. And just in case those in the industry needed further evidence, nine in ten (89%) of subscribers said they would pay for more subscriptions if they were simpler to manage. With the same emphatic results in the US and throughout South East Asia, Super Bundling is emerging as a global trend and opportunity. The case for Super Bundling became undeniable.

On their own, these reports should have been enough for the industry to sit up and take notice. Together, they made a compelling case that the subscription economy was experiencing a tectonic shift.

No doubt there will be some in the industry happy to continue to plough on as before. But to do so would be to deny the undeniable…that consumer demands have changed…and that the industry needs to respond or risk losing out at the point subscription bundling takes off.

The first signs that the industry was preparing to embark on a transformational shift emerged in July when a survey revealed that almost nine in ten (88%) of the leading telcos in the US and UK were planning to offer Super Bundling as they prioritized revenue growth and customer retention.

It also found that more than eight in ten (82%) telco leaders were convinced that offering Super Bundling and content aggregation was key to customer retention and acquisition. While almost nine in ten (88%) said Super Bundling would provide a ‘vital’ source of future revenue.

Juniper Research predicted that the number of subscriptions is set to rocket to more than 4.2 billion by 2026 generating some $600 billion in revenue. This was swiftly followed by a report by Omdia which revealed that 20% of all streaming video subscriptions are now sold through bundling partnerships with telcos with this number expected to grow to a quarter (25%) by 2028.

Analysts concluded that this growth in bundling was being driven by telcos’ long-term strategic desire to expand beyond their core data and voice services as they look to increase subscribers and reduce churn — a recurring theme that was picked up most recently in the StreamTV report mentioned earlier. It also, perhaps, reflects that ARPU (average revenue per user) for many telcos is flat or even declining.

In the USA, for example, Verizon has been making waves with its +play platform which brings together Netflix, Disney+, HBO Max, Paramount+ and more. Similarly, in Australia, Optus has launched SubHub, providing flexible access to dozens of streaming services and subscriptions.

The position today

Of course, Bango has been instrumental not only in highlighting the shift to a more consumer-centric approach to subscription services but also in providing the technology that underpins the move to Super Bundling.

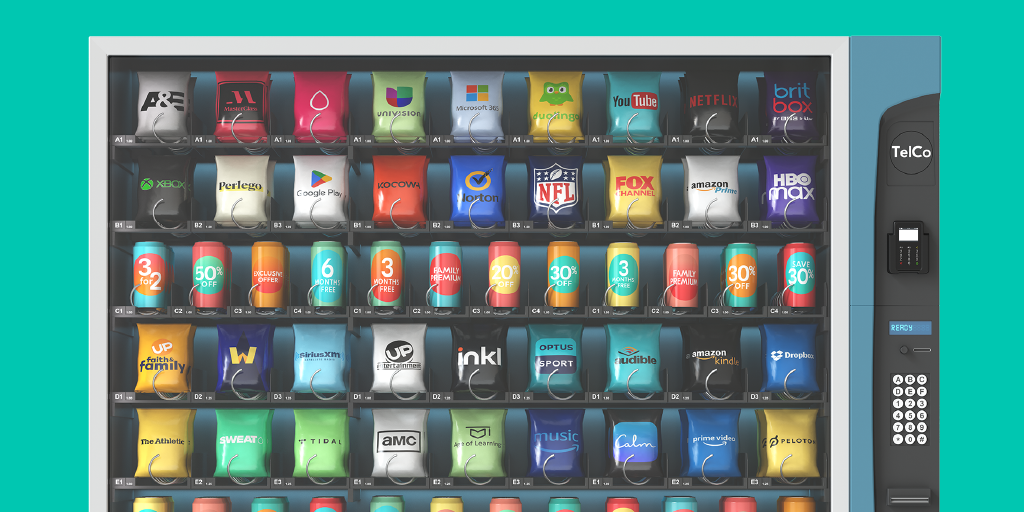

Our Digital Vending Machine® is a game-changing solution that empowers telcos, banks, retailers and more to Super Bundle subscription services for their customers. It offers customers access to numerous subscription services via a single content hub, simplifying payments into a convenient monthly bill.

The importance to both resellers and subscription merchants of a standard technical platform to enable Super Bundling was recognized in November 2023 when Bango was awarded ‘The Platform Award’ at the prestigious World Communication Awards 2023. It’s an accolade that not only celebrates innovation and excellence in global telecoms, it recognizes that Bango is responsible for a unique value proposition in today’s fiercely competitive market.

While in September, we also scooped the ‘Mobile Payments Innovator of the Year’ award at the prestigious Global Carrier Billing Awards 2023.

As Guillermo Escofet, principal analyst, Consumer Platforms at Omdia, said: “Bango is a leader in enabling telcos to roll out Super Bundling offerings. Telco super bundles can offer much greater choice than that offered by tech giants’ walled-garden bundles, such as Amazon Prime and Apple One – not only because services can come from any number of different providers but also span any number of service types. In that respect, telcos are the best suited for pick-and-mix Super Bundling.”

2024 – the year ahead

So, that’s a brief look at 2023. But what’s in store for 2024? Here are my top ten predictions for the year ahead.

- Even more consumers will activate and manage their subscriptions using a Super Bundling hub, with one in five people expected to access digital content this way. In some regions, I expect as many as one in three of all subscriptions to be managed through Super Bundling hubs.

- On average, consumers who use a hub like those powered by the Digital Vending Machine will sign up to six subscriptions…compared to just four who do not.

- Telcos and broadband providers will be the most common providers of Super Bundling hubs followed by banks, credit unions and then retailers.

- 2024 will see continuous experimentation in how to add value to the consumer. This will include — for the first time — competitors combining their efforts and coming together for the benefit of consumers with competing products bundled together and packaged at a single price.

- Beyond TV and movie streaming, consumers will look to take out more subscriptions in areas such as gaming, lifestyle, insurance, transportation and consumables.

- New consumer features — such as pausing subscriptions, porting, consolidated billing and flexible household plans — will be offered by Super Bundling providers.

- We’ll see continued trials of time-specific subscription packages — such as annual, monthly, seasonal or even festive-related options. We can also expect to see greater price flexibility with ad-funded options pushing prices down or non-ad-funded packages pushing prices up.

- There will be consolidation in the streaming industry — especially in the US.

- Expect to see new types of subscription products coming on stream — or different versions of existing products that are subscription-funded — as these new Super Bundling distribution channels open up.

- We’ll see bundling occurring in more unusual and unexpected places as subscription products seek new customers, and first-party product companies with existing payment relationships look for ways to leverage Super Bundling to their advantage.