As the first market hit by subscription price hikes, necessity is breeding invention in LATAM. Companies are getting creative, building bundled packages that meet subscriber demands while offering the best deals. The next move? It can only be Super Bundling.

If there’s one subscription region that has the potential to transform the way we think about subscriptions in the coming years, it’s Latin America. Currently valued at USD$20 billion, this figure is expected to double in the next two years as demand for convenience and instant access to services drive a subscriptions boom.

When it comes to the streaming space, LATAM has long been at the front of the pack, used as a testing ground for everything from ad tiering to password crackdowns — and yes, even price increases. The region’s telcos have also led the charge in offering bundled packages that include SVOD, with the number of streaming subscriptions sold in this way forecast to increase from 37% in 2023 to 49% in 2028.

To better understand this vibrant market, our new Subscription Wars: Latin America research surveyed 6,400 LATAM subscribers across six countries: Argentina, Brazil, Chile, Colombia, Mexico, and Peru.

Here are the highlights…

Post-paid contracts and mobile tiers

For years, pre-paid plans have dominated the mobile market throughout LATAM, giving customers greater control over spending and providing a safety net during turbulent economic times.

Today, that’s all changing. Post-paid options are muscling their way into the market, with a third of respondents (30%) now on contracts. Pre-paid customers are also acting more and more like their post-paid counterparts, with over half (55%) repeatedly topping up with the same amount, at the same time, every month.

This is good news for subscription providers, who can benefit from consumers who are more at ease with regular recurring bills. In turn, mobile providers can leverage the popularity of subscriptions services as a further incentive for customers to pay regularly – accelerating the shift to a majority post-paid market.

This behavior change is also helping to drive a surge of mobile-first innovation in the streaming and subscription space.

Take Paramount+ for example. Through the introduction of a “mobile tier’, Paramount subscribers can access mobile-only content at a lower price point. In partnership with mobile providers, this approach could help retain the 50% of subscribers who watch Paramount+ on their mobile for longer.

Price hikes hit subscribers

The effects of 2023’s “streamflation” have hit LATAM subscribers hard. Our research shows that 40% of LATAM subscribers now pay for a service they used to access for free. More than two-thirds (68%) say they can’t afford all the subscriptions they would like, and more than half (56%) have had to cancel a subscription following rising prices.

To combat some of these financial challenges, subscription services are offering ad-tiering as a key solution for price-sensitive LATAM customers who are looking for better deals and greater flexibility. While ad-tiering is gaining ground in other regions, Netflix is forecast to generate around $600 million U.S. dollars in 2029 from ad-supported VOD operations in LATAM alone.

80% of subscribers say too much choice

Tiered pricing is certainly helping the pain of price hikes amidst economic uncertainty. But price is not the only factor that impacts subscriber growth and retention in LATAM.

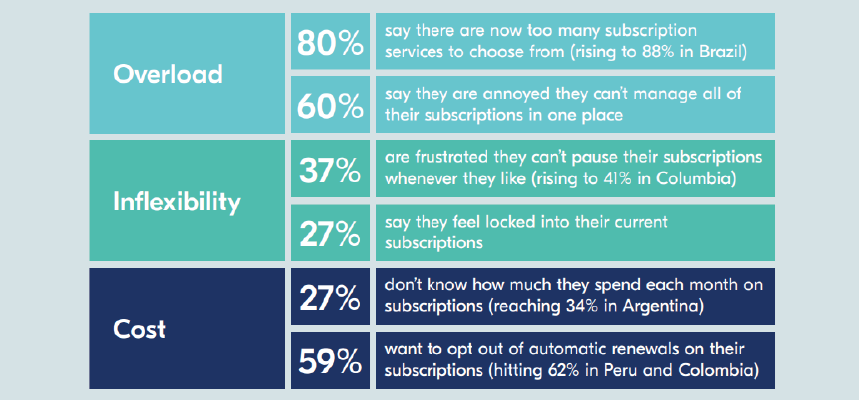

Our data reveals subscribers are increasingly frustrated with having too many subscription services to manage. Four in five (80%) say there are now too many subscription services to choose from, while one in four (27%) say they don’t know how much they spend each month on subscriptions.

Multiple subscriptions, combined with inflexible subscription management, and rising prices are combining to create a major headache for LATAM subscribers.

LATAM subscriber frustrations

Super Bundling, the next step for LATAM

In an effort to mitigate these frustrations, LATAM subscribers are turning to bundling.

One in five (21%) now only buy their subscriptions indirectly, signing up via bundles and deals from third-party providers. For example, Latin American telco giant Claro offers Prime Video with Claro TV via its home and post-paid mobile bundle plans, while Peru’s Movistar TV offers internet contracts with Disney+ and Star+ included.

But these bundles only include SVOD and not the other services like gaming, well-being, and retail that subscribers are also having to manage. The limitations of bundles like these don’t help to solve the issue of subscriber overload, lack of flexibility, and the increasing financial burden of managing several subscriptions across different platforms.

This is where Super Bundling is the obvious next step for those who want to expand their subscriber revenue. In the US and Australia, full-service “content hubs” like Verizon +play and Optus SubHub are transforming the subscription landscape by giving subscribers more choice and control through an all-in-one subscription management platform.

Now, LATAM consumers want a piece of the action.

In fact, over three-quarters (79%) of LATAM subscribers say they want one app to manage all of their subscriptions and accounts, rising to 82% in Peru. Over two-thirds (68%) would also spend more time using their subscription services if an all-in-one subscription platform were available. More than half (58%) would sign up for more subscription services thanks to this kind of platform.

One centralized bill is a top-requested feature for content hubs.

Telcos lead the charge

And who do LATAM subscribers want to provide all this? Given the region’s mobile-first mindset, it’s unsurprising that the majority (55%) say they want their mobile providers (telcos) to spearhead the creation of centralized content hubs.

LATAM’s price-sensitive subscribers like the idea of Super Bundling so much they would be willing to pay for it. Over half (56%) would pay a higher bill if a package of popular subscriptions were automatically included. When asked how much higher, the average subscriber said they were open to paying 21% more on their mobile bill if subscriptions were included in the price.

LATAM’s mobile-first, price-sensitive consumers are showing a strong preference for bundled services, revealing a clear path ahead for companies looking to expand their market share and revenue. Super Bundling stands out as a crucial step forward.

For companies aiming to stay ahead of the curve, understanding and leveraging the unique dynamics of the LATAM market will be vital. To delve deeper into the trends and opportunities in this space, download our report.

For more insights into LATAM’s subscription market, download the full Subscription Wars: Super Bundling Awakens — Latin America report here