The European subscriptions market is thriving and now is the time for companies to take advantage. Our latest research exposes the regional trends and challenges to find out how.

This summer, all eyes will be on Europe as it plays host to a jam-packed schedule of sporting competitions – including the biggest of all: The Paris 2024 Olympics. Our latest Subscription Wars: Europe report reveals how the bumper summer of sport could accelerate subscription sign ups in an already thriving market, with all signals pointing to victory for telcos as the leading provider of bundled subscription services.

But insights gleaned from our research of 5,000 European subscribers show that to ensure pole position, companies in this space need to innovate to overcome specific consumer challenges as the subscriptions economy grows across Europe.

Download our Subscription Wars: Europe report to access the insights in full.

Could this be a summer of subscriber growth?

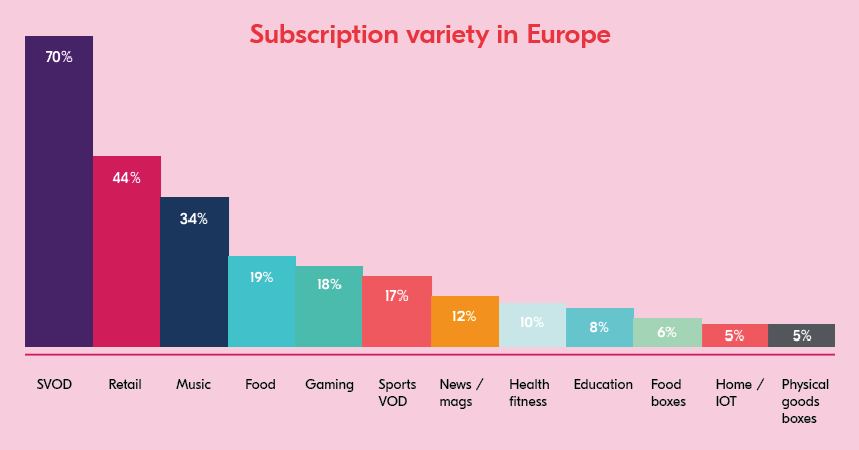

Our research revealed that European subscribers have on average 3.2 subscriptions. While subscription video on demand (SVOD) leads the pack in terms of popularity among European audiences, other types of subscriptions such as retail, gaming and food boxes are also in demand. Subscribers in the UK and Germany have the most subscriptions at 3.3 on average, while France has the least at 3 per person.

Compared with the average American subscriber who has 4.5 subscriptions, European consumers appear to be lagging behind. That said, it also appears that they want to sign up for more.

Data indicates that the upcoming summer of sport is set to strengthen subscription adoption across Europe, with 1 in 5 European subscribers (20%) planning to sign up for a new subscription service to watch the Olympics, and 22% doing the same to watch the Euros.

Formula 1, Tour de France and Wimbledon are likewise attracting consumers to create new accounts with subscription services.

How have subscribers responded to rising costs and the introduction of advertising?

Increased prices and the cracking down on password-sharing against the backdrop of a cost-of-living crisis has had an impact across all five countries we surveyed. While the introduction of ad-funded tiers has offered subscribers a more affordable price point, many are cutting back to save money.

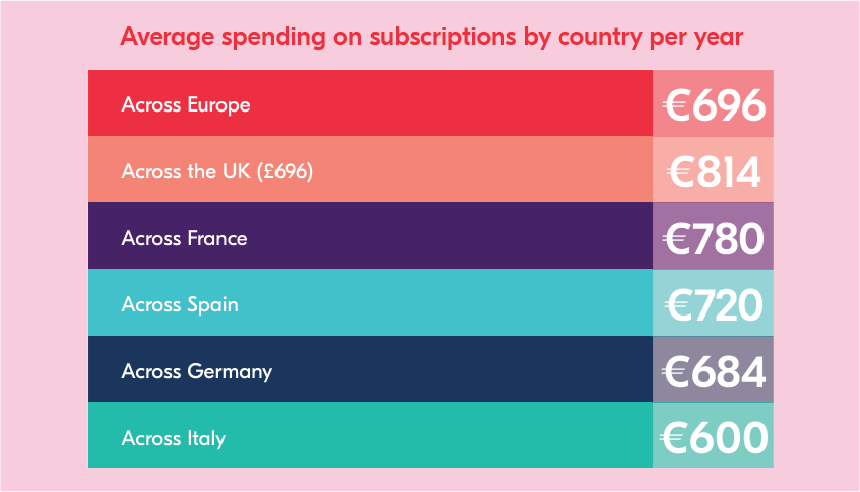

Subscribers in the UK spend the most on average at €814 (£696 per year), while those in Italy spend the least at €600 annually. Nearly half (45%) of subscribers in the UK have canceled due to recent price hikes – yet it was subscribers in Italy who came out as the most likely to cancel a subscription service following a price increase (48%).

However, subscribers in France pay the most given the fact that they have the least subscriptions on average (3 compared with the UK’s 3.3). The crackdown on password sharing has seen a third (33%) of French subscribers now pay for a service they used to access for free.

With a lower average monthly spend than that of their European neighbors, subscribers in Germany are the least likely to cancel following price hikes and the introduction of ads. Yet over half (53%) say they can’t afford all the subscriptions they want.

In Spain, the introduction of advertising would appear to be least popular with almost a third (31%) of subscribers canceling as a result. 81% say paid subscriptions should never include ads – more than any other nation in our survey.

It will be interesting to see how telcos and subscription service providers continue to respond to the economic squeeze on subscribers in Europe with more dynamic price offerings. One thing is clear, subscribers want more.

Subscriber fatigue is driving content piracy – but there’s a clear solution

Subscription overwhelm remains another concern for European subscribers. Yet it’s not so much the number of subscriptions that’s causing fatigue, it’s the reality that they have to manage access, payment and consumption across different platforms.

Our research shows that just under half (46%) are annoyed that they can’t manage all of their subscriptions in one place. The result? A rising number of subscribers turning to online piracy. 1 in 5 (19%) subscribers surveyed are using pirate streaming services as the only way to access all content in one place. In France, this number was 22%. Disjointed services and a lack of all-in-one legal options for content were key reasons cited by Europe’s largest study into piracy behind the rise in piracy across the region.

The call for one app to manage subscriptions and accounts in Europe is getting louder. In the US and Australia, full-service ‘content hubs’ like Verizon +play and Optus SubHub allow customers to manage everything from their Xbox Game Pass to their Snapchat+ and Kindle accounts all on one platform.

Now subscribers in Europe want a piece of the action. Our research reveals that over half (58%) of European subscribers are demanding one app to manage all of their subscriptions and accounts. In Spain, it’s as high as 67%.

Hello Super Bundling

Consolidated subscription management would help subscribers manage the overwhelm, at the same time as giving them more control over their spending in a difficult economic climate.

In fact, subscribers would actually be willing to spend more on subscriptions overall if an all-in-one subscription platform were available.

Almost half (46%) of subscribers would spend more time engaging with their subscriptions and 40% would also sign up for more services if an all-in-one subscription platform were available.

Just like in the US and Australia, European subscribers want telcos to offer these all-in-one content hubs – and they’re willing to pay for it. Over a third of subscribers (38%) would pay a higher mobile or internet bill if a package of popular subscriptions was automatically included, with 35% of subscribers willing to pay an extra 25% or more.

This is where Super Bundling offers a clear path forward. With Super Bundling, telcos can offer subscribers access to potentially hundreds of content providers via a subscriptions “hub” manager – all paid for via a single monthly payment.

The Super Bundling solution is a win-win for both sides of the debate. Telcos, subscription services and content providers can all capitalise on improved customer satisfaction and the resulting gains in growth and retention, while subscribers can finally have a better way to manage – and enjoy – their subscriptions.

What’s exciting is that the possibilities for these all-in-one subscription platforms – how they look, feel and what they include – are practically limitless. Let the games begin.

For a deeper dive into the European subscriptions landscape, download our Subscription Wars: Europe report.